CDK Global

Generative Market Research for Car Dealerships

What did we research?

CDK Global is a B2B company which creates software for use by car dealerships. As a part of their ongoing research initiative, CDK leadership engaged UT graduate students to identify opportunities for reducing consumer tension throughout the car buying process.

About the Project

Client

CDK Global

Timeline

8 Weeks

Team

Abigail Gore, Tara Rastogi, Dustin Najera, David Kerr

My Role

Graduate UX Researcher with The University of Texas iSchool

Advisor

Stacey Oliver

My Contributions

Led portion of participant interviews

Coded notes and distilled insights to affinity map

Created user persona

Co-created journey map

Co-created slide-deck presentation and accompanying visuals

Primary Objectives

Identify pain points and delights in the consumer’s journey to vehicle ownership

Investigate and interpret root causes of said experiences

Present opportunities for impactful change to CDK Global leadership

Process & Results

What was the plan?

-

1. Client Consult

-

2. Research Plan

-

3. Screener

-

4. User Interviews

-

5. Data Analysis

-

6. Affinity Diagram

-

7. Insights

-

8. Persona

-

9.Journey Map

-

10. Presentation

Who did we talk to?

We screened for individuals who purchased a new car after 2020, to account for changes to the process wrought by COVID.

When building our persona and journey map later on, we focused on the following characteristics of our participants:

30-something

Professional salary, but price conscious

Conducted research before visiting dealership

Wishlist specified make/model, color, and features

How did we analyze?

Everyone on the research team had experience purchasing a new vehicle. We recognized this potential for bias early on, and intentionally completed multiple fresh takes at affinity diagramming over several days. When we began seeing similar themes emerge, we knew that we were on the right track.

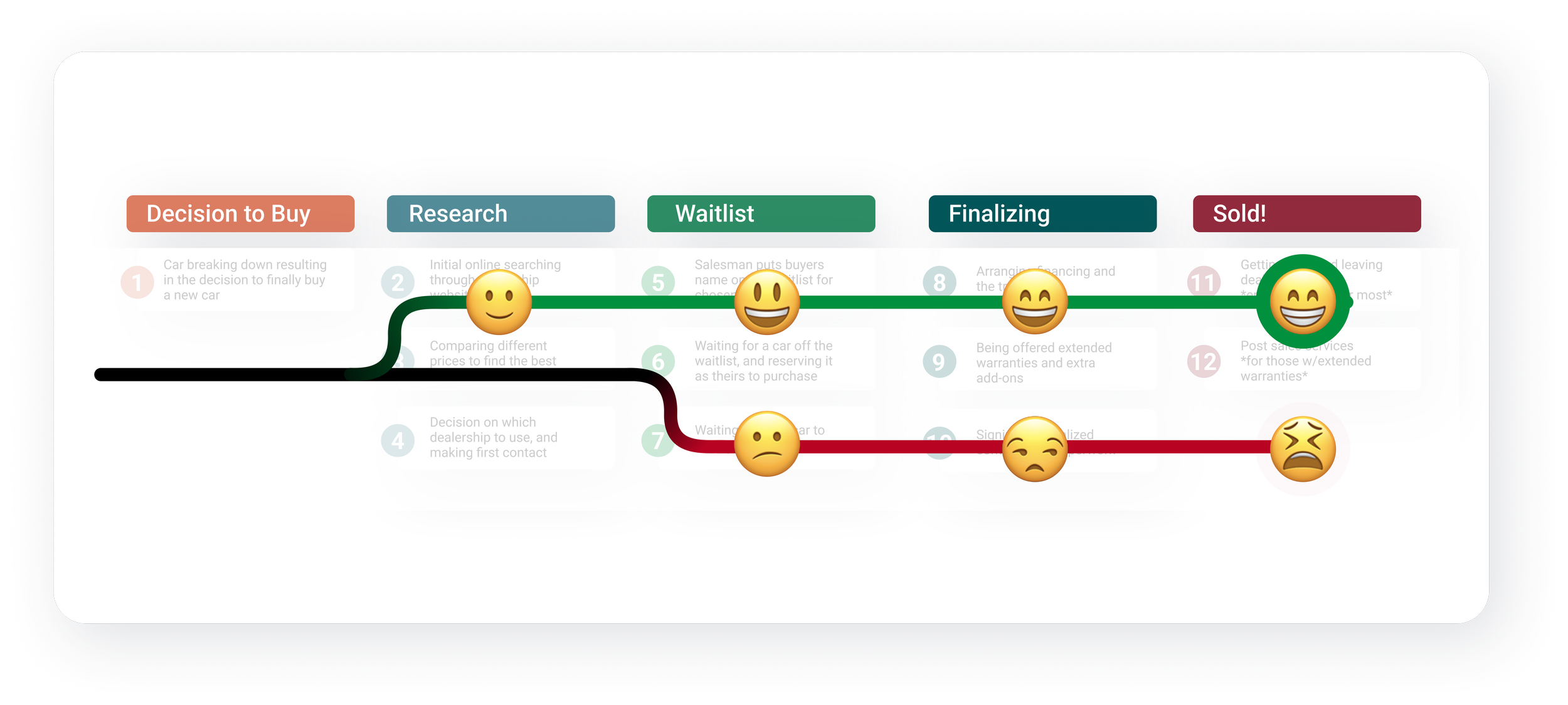

After building a persona from our user data, we created a journey map to help us understand where various pain points occurred in the car buying process. The framework developed at this stage served as a means of communicating participants’ perspective to other invested parties.

What did we discover?

Opportunity for Staff Training

A salesperson can make or break the experience. We all know that actions speak louder than words, and our participants were able to tell when sales people were attempting to serve their needs vs. helping themselves. The resulting consumer experiences forked early and stubbornly resisted change.

“He made me feel comfortable.

“He was able to shave off $2,500 from the price.”

“ He was a good communicator and delivered as promised.”

“He kept trying to upsell us on warranties. When I say no I mean NO, not ‘Try harder’.”

“I don’t think he was outright lying to us; I think he was trying to make a sale happen, and he told us things (falsely) assuming they would work out.”

Opportunity for Visible Status Updates

It’s crucial to keep in regular contact. Our participants had differing experiences regarding the flow of information during their vehicle purchase. In many cases, a lack of updates led to misunderstandings and broken trust.

(The car showing) was really easy to sign up for. It was just like making a doctor's appointment.”

CarMax offered a tracker. It estimated what day (my vehicle) would arrive, like tracking an amazon package... I didn’t have to wonder when the heck my car would get here.”

“He reserved the wrong vehicle for me to look at. It was done off-screen which was the problem... Whatever they see on their end, I want to see on my end.”

“The vehicle arrived unexpectedly while we were out of town, and the dealership pressured us to sign a contract sight unseen. That almost shut down the deal.”

Main Takeaways

Dealerships in Positive Experiences…

Prioritized buyer goals

Provided consistent, accurate info

Kept buyers up-to-date with check-ins

Dealerships in Negative Experiences…

Pushed their own agenda

Provided inconsistent or inaccurate info

Surprised buyers with status changes

Tell Me More…

It’s noteworthy that the pain points reported by our participants were not focused on cost, nor on the product they drove home in. Ultimately, participants cared about how they were treated by the dealership. More specifically, they cared whether the experience made them feel like valued clients, or faceless marks.

The nature and timing of our research obscured the potential impact on dealership attrition rates, but one wonders whether some of our participants would have continued with the same dealership in a less competitive new vehicle market.